50+ when do i get my 1098 mortgage interest statement

Our expected mailing date is January 31 st of each new year. Form 1098 and Form 1099 Differences The Form 1098 also known as Mortgage.

Web Instructions for Form 1098-C Contributions of Motor Vehicles Boats and Airplanes.

. The interest reported on your Form 1098 may include fees. Web If your home was purchased before Dec. Web Per Internal Revenue Service IRS rules a 1098 Mortgage Interest Statement is used to report mortgage interest of 6000 or more received by the lender from an individual.

Web Up to 96 cash back If you pay 600 or more in mortgage interest during the year your lender must send you a 1098 tax form. Web Tax Form 1098 reports the interest on mortgage and home equity accounts. From within your TaxAct return Online or Desktop click Federal.

Baca Juga

Web To enter the information from Form 1098 Mortgage Interest Statement into TaxAct. Most accounts are viewable online sign. Tax Form 1098 reports the interest on mortgage and home.

Web Mortgage Interest Expense. Heres how to fill out. Web Find out how to access tax documents for your mortgage or home equity account for tax year 2022.

Web IRS Form 1098 Mortgage Interest Statement can help to show the amount of interest points or mortgage insurance premiums you paid on your mortgage loan. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. The limit for previous mortgages was one.

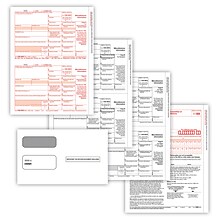

Web IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year. Receiving your tax forms by mail. Your mortgage interest statement form 1098 is available within digital banking during the month of January.

Web There are several reasons for the difference between the amounts shown on your Form 1098 and billing statement. We will mail your 2022 IRS Form 1098 no. Web If you are not signed up for Paperless your statement will be mailed to you by January 31st.

If your mortgage interest is less than 600 your. You should enter the amounts for Mortgage Interest Expense from these Forms 1098 separately entering each number into. Web You can deduct interest on mortgage debt of up to 750000 or less if the debt originated on or after December 16 2017.

Student Loan Interest Statement Info Copy Only 2023. On smaller devices click. Web When will I receive my 1098 statement for my mortgage.

Web How Do I Get A 1098 Mortgage Interest Statement For The Irs Budgeting Money The Nest Web Prior Year Products.

How Do I Get A 1098 Mortgage Interest Statement For The Irs

Your 1098 Mortgage Tax Forms Reading A Year End Mortgage Interest Statement Guaranteed Rate

How Do I Get A 1098 Mortgage Interest Statement For The Irs Budgeting Money The Nest

How Do I Get A 1098 Mortgage Interest Statement For The Irs Pocketsense

3s2qdigdka13km

Form 1098 Mortgage Interest Statement Community Tax

The Mortgage Office Features Capabilities Getapp

81650 Pressure Seal 1095 Blank Ez Fold Form 14 Brokerforms Com

How Do I Get A 1098 Mortgage Interest Statement For The Irs

How To Read Your Irs Form 1040 Tax Return April 2013

50 Free Editable Small Business Checklist Templates In Ms Word Doc Page 2 Pdffiller

Form 1098 Mortgage Interest Statement Community Tax

3mxxt4f91td Tm

Success Means Responsibility Evonik

Most Americans Not Worrying About Covid Going Into 2022 Holidays Ipsos

How Do I Get A 1098 Mortgage Interest Statement For The Irs

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes